workers comp taxes for employers

How to calculate workers compensation cost for an employee in three easy steps. When your employees are receiving workers compensation benefits they may wonder if theyll have to pay taxes on them.

The Workers Compensation Notice Employers Resource

Are Workers Comp premiums a tax.

. I always try to write something on premiums being viewed as a tax this time of year. But risk management is only part of the. Employees receive a W-2 from their employer each year and the employer pays taxes and benefits on their behalf.

A workers compensation attorney might suggest you spread out lump-sum payments or shift to Social Security retirement benefits to minimize the offset and avoid tax issues. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. Workers compensation is typically one of those legally required employee benefits.

The simple answer is there is no such thing as a 1099 employee. If your employer has denied you insurance after sustaining a workplace injury you should hire Antioch workers comp lawyers as soon as possible. Find Out How EY Helps Businesses Successfully Overcome Various Tax Challenges.

The workers compensation system in Georgia is defined by statute in the Workers Compensation Act and was intended to be a no-fault system with benefits for the employer and the employee. Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each plus an additional 09 withheld from the wages of an individual paid more than 200000 are set by the IRS. TaxAct Business Tax Filing Prioritizes Your Security Helps Maximize Your Deduction.

Do you claim workers comp on taxes the answer is no. Whether you pay Ohio BWC KEMI or popular private carriers like Travelers or Liberty Mutual one thing that is common across the board for work comp insurance is that your insurance premium looks more like a payroll tax then an insurance bill. These Days Most Workers Compensation Insurance Premiums Look Like Payroll Taxes.

Injury management is the area where most workers compensation cost-cutting strategies are focused and with good reason. Every employer required to be covered by the Workers Compensation Act or who elects to do so and every employee covered by the Act must pay a quarterly fee called the workers compensation assessment fee. In Illinois all employers have to carry workers comp insurance if they have at least one part or full-time employee on the payroll.

Ad Helping Businesses Manage Their Tax Responsibilities Through Remote Tax Tools. Ad Free Tax Filing Help. The employer must obtain a workers compensation insurance policy.

Both employers and employees are responsible for payroll taxes. With 100 Accuracy Guaranteed. Our roots stretch back to 1913 meaning we have the experience financial stability knowledge and resources to provide the coverage and tools that make insurance easy for Americas small businesses.

Requires all employers with or without workers compensation insurance coverage to comply with reporting and notification requirements under the Texas Workers Compensation Act. However retirement plan benefits are taxable if either of these apply. Posted 1010 am by Bob Edens filed under Workers Compensation Lawyer.

Ad Talk to a 1-800Accountant Small Business Tax expert. The subject of a Workers Comp tax comes up each year as today is the end of our tax filing season. The quick answer is that generally workers compensation benefits are not taxable.

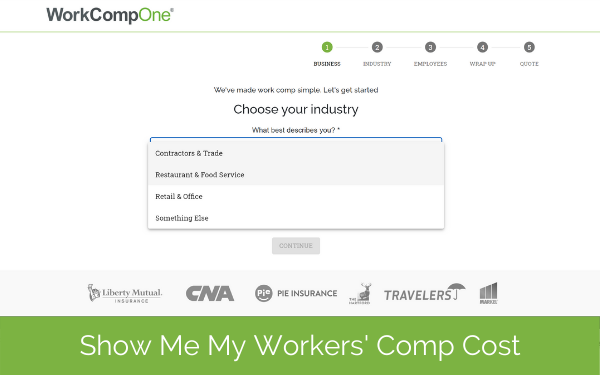

Determine the class code of your employee. Workers Compensation Texas Law. Class codes are assigned based on the industry of your business.

Most businesses participate in the states workers compensation program. However each state specifies its own tax rates which we will. But as we noted most workers compensation claims are straightforward affairs.

Even if the employee hasnt given this notice the employer may still be obligated to provide the forms if it knew about the injury. The fee is similar to a tax and is. An individual worker is either a W-2 employee or they are a 1099 Independent Contractor.

Get Your Max Refund Today. Typically employers must provide injured employees with a workers compensation claim form within 24 hours after the employee has given notice of an on-the-job injury or work-related illness. For over a century weve been providing Americas small businesses with cost-effective workers compensation insuranceWith our emphasis on financial stability and fast efficient claims service we now serve clients in 46 states and the District of ColumbiaEMPLOYERS remains focused on keeping Americas Main Street.

With agents from coast to coast EMPLOYERS provides targeted workers compensation insurance solutions for independent entrepreneurial companies. Affordable Tax Filing Made Easy. Payment is due by the last day of the month following the end of the quarter.

You are not subject to claiming workers comp on taxes because you need not pay tax on income from a workers compensation act or statute for an occupational injury or sickness. Generally employers must provide workers compensation industrial insurance coverage for their employees and other eligible workers. The main consideration is how the employer views the payouts.

Reining in workers compensation costs through safety efforts effective return-to-work programs and best practices in medical management are proven to contain overall costs. Provides for reimbursement of medical expenses and a portion of lost wages due to a work-related injury disease or illnessBenefits are available only. There are two ways to provide this coverage depending on the financial resources of your business.

Workers comp laws vary from state to state so it would pay to get legal advice in this situation. Get the tax answers you need. It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury tendinitis or carpal tunnel.

TurboTax Has A Variety Of Solutions And Tools To Help You Meet Your Tax Needs. The fee for covered employees working on the last day of the quarter is 200. A Workers Compensation Insurance Company.

The postman just picked up all of our tax forms whew. We have the experience and knowledge to help you with whatever questions you have. Employers must report and pay both fees using.

The fee for the employer is 230 times the number of covered employees working on the last day of the quarter. Depending on your state workers compensation class codes are either set by your state workers comp agency or by the National Council on.

Workers Compensation Attorneys In York Pa Free Confidential Consultation

Workers Compensation Insurance Overview Amtrust Financial

Texas Workers Compensation Laws Costs Providers

Is Workers Comp Taxable Workers Comp Taxes

How A Worker S Comp Settlement Is Calculated Bdt Law Firm

What Wages Are Subject To Workers Comp Hourly Inc

When Does Workers Comp Start Paying After A Workplace Injury

Costratesadvisor Com Payroll Analysis Report Workers Comp Insurance Analysis Payroll Taxes

5 Requirements For Workers Compensation Eligibility

How Does Workers Compensation Work In Vermont Sabbeth Law

Workers Compensation Insurance Requirements Costs More

How To Calculate Workers Compensation Cost Per Employee Pie Insurance

Ssd And Workers Compensation Benefits

California Workers Comp Ebook Injured On The Job Take Charge Personal Injury Claims

How To Calculate Workers Compensation Cost Per Employee

Permanent Disability Pay In California Workers Comp Cases 2022

Are Workers Comp Benefits Adequate Legal Talk Network